Google Payments

Jan 2016 – Sep 2017

CUJ

Platform

Consumer

Innovation

Critical User Journey

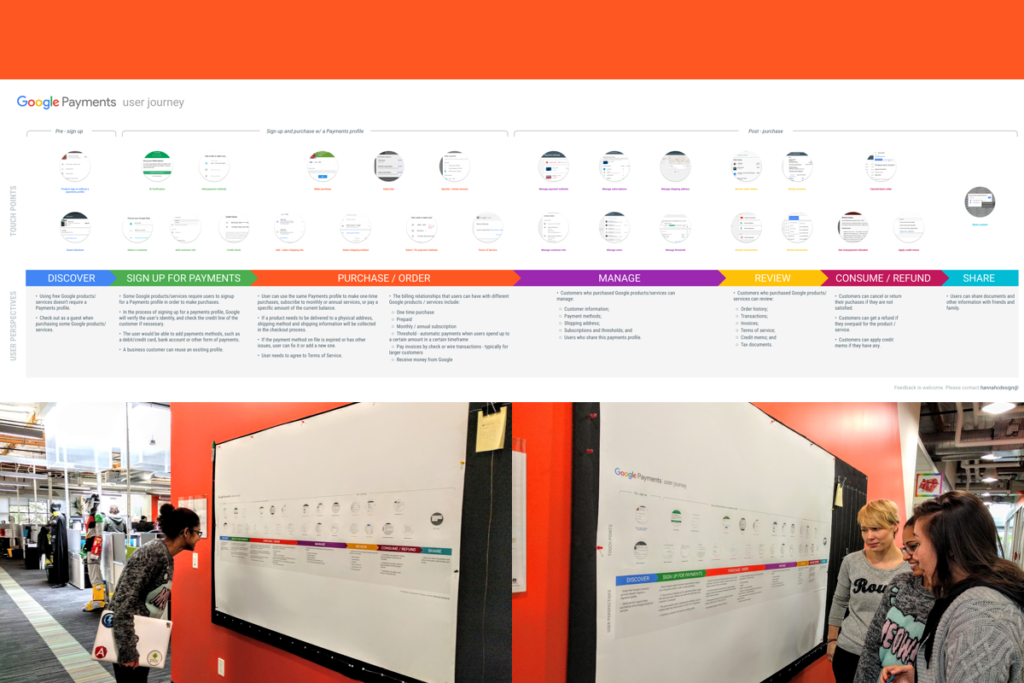

Payments is a core component for most businesses. The first thing I did when I joined Google Payments in Jan 2016, was initiating a journey mapping project to understand the end-to-end user experiences.

Payments journey map

This project was aimed to help the team better execute Product Excellence methodologies in our daily workflows. The journey map represents interview insights from a cross-functional team of 30+ members, including designers, product managers, and engineering leads. The journey map was printed and posted at the main Payments office, which maps out the generic flow that users and customers interact with our products: discover, signup for payments, purchase/order, manage/review, refund, and share.

Platform components

There were over 55 Google products that use Google’s payments platform to manage payments instruments (e.g., credit cards on file) and process payments in 234 countries.

One of our 2016 company OKRs were to migrate all 55+ integrators to our 4th generation of Google’s payments platform. ~100B of Google’s money moved through this payments system and on an average we got over 10k QPS and maintained a database of over 400M customers and users.

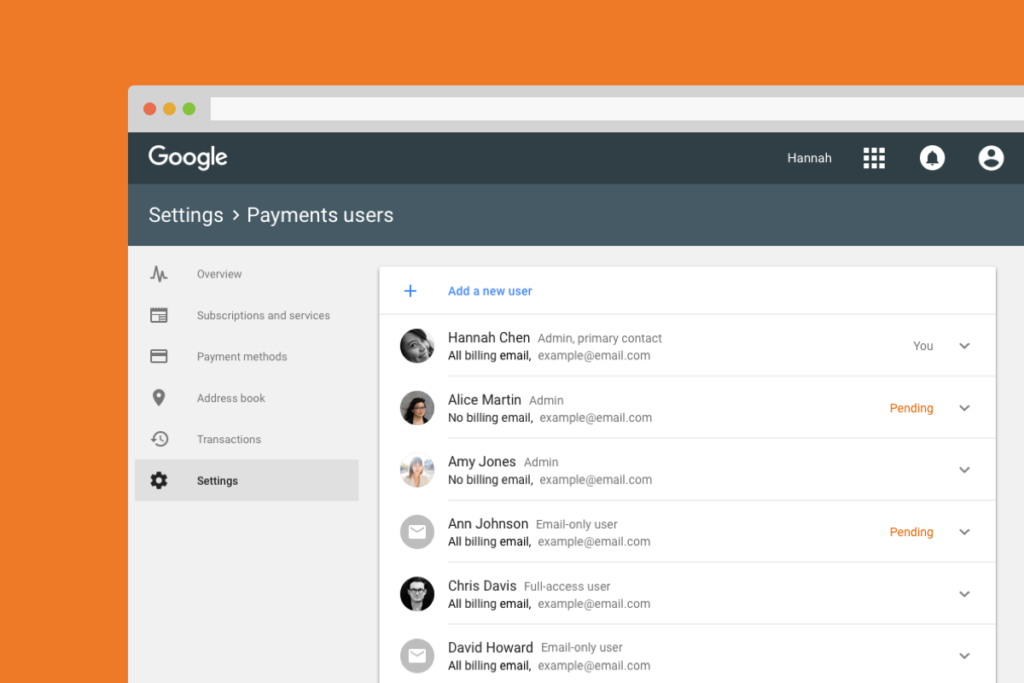

I designed the payments user profile and permission client-facing UI components for this rewrite of our platform and managed cross Product Area partnerships with internal integrators, including AdWords, Youtube, Play, Express, Cloud, Assistant, Photos, Project Fi, AdSense, and AdMob.

Payments Permissions

Payments Permissions is a new feature that enables 400M buyers, and 25M active customers (representing 95% of Google revenue) to manage payments users and configure those users’ communication preferences.

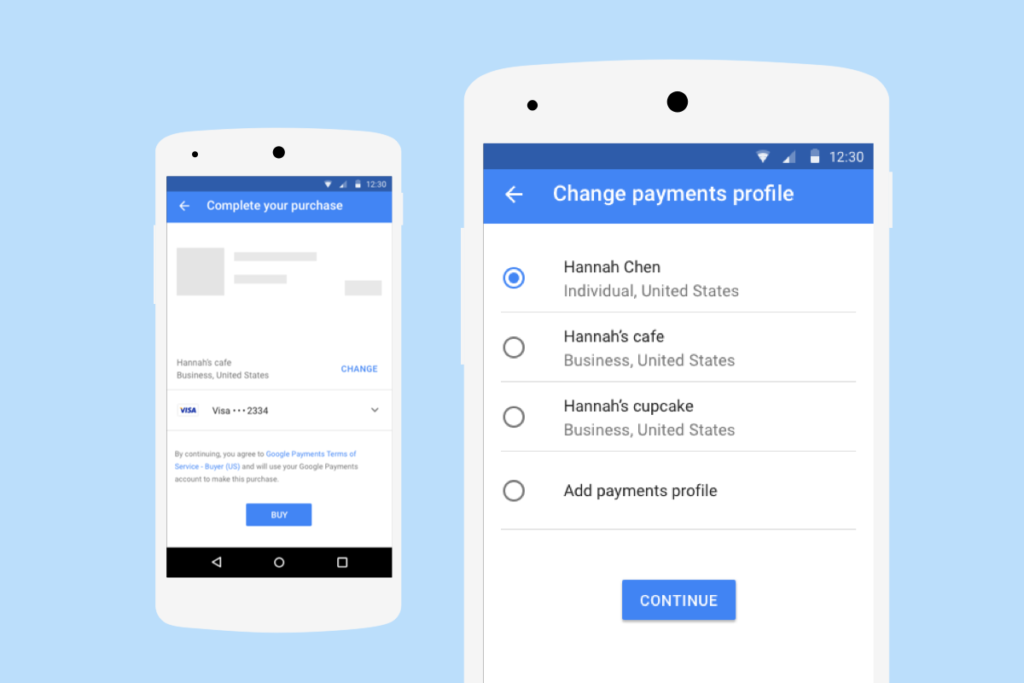

Payments Profile

Payments Profiles will allow users to sign up for more than one service from Google without having to re-enter their payments information or having to verify their identity yet again, boosting signup conversion rate by ~20%.

Consumer apps

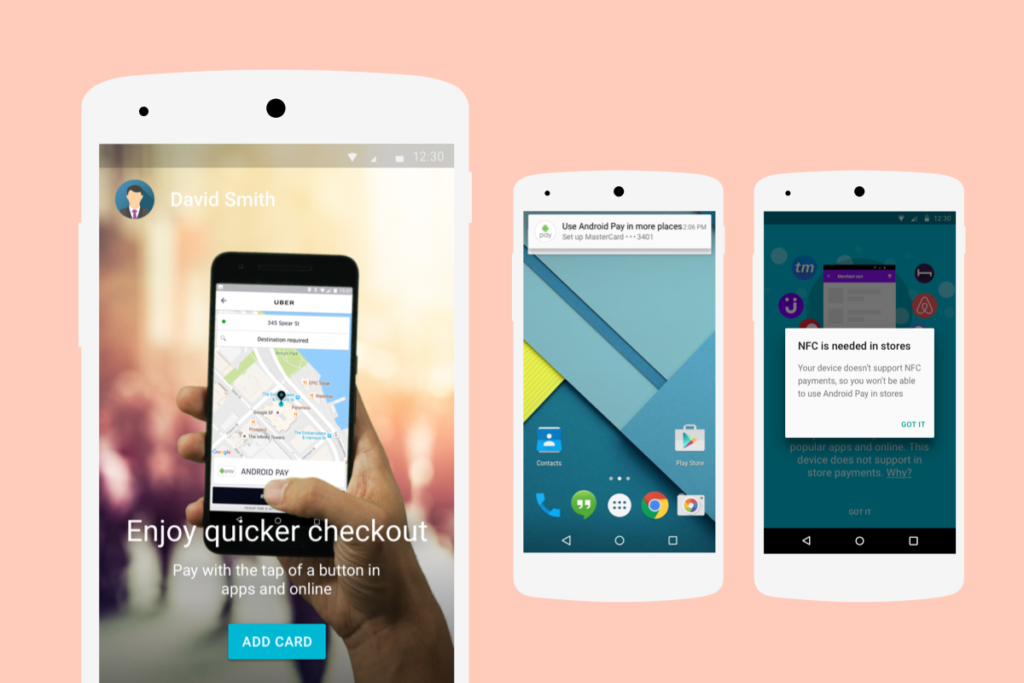

I also took ownership of the design for two consumer features: Android Pay in-app and Chrome auto-fill.

Android Pay In-app

To improved Android Pay In-app experience, we increased eligible payments instruments (from 2M to 100M) and supported devices (from 70% to 97%), to give users as many payment options as we enabled when they shop in a merchant app.

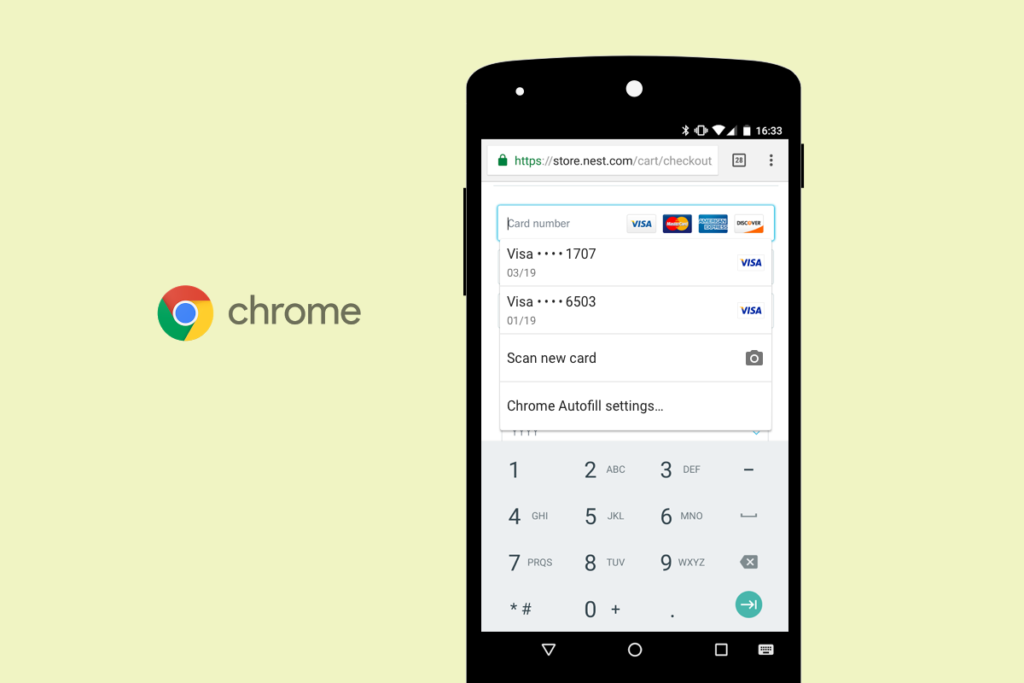

Chrome auto-fill

I established the design system for payments autofill feature on multiple platforms, including Chrome browser on desktop and Android Pie. I partnered with our product manager to run experiments and collect data, which allowed us to select from our multiple design proposals and implemented the one that most improve the click-through rate of payments information on Chrome browser.

Innovation areas

Besides my primary allocations, I was actively engaging in some of the innovation areas.

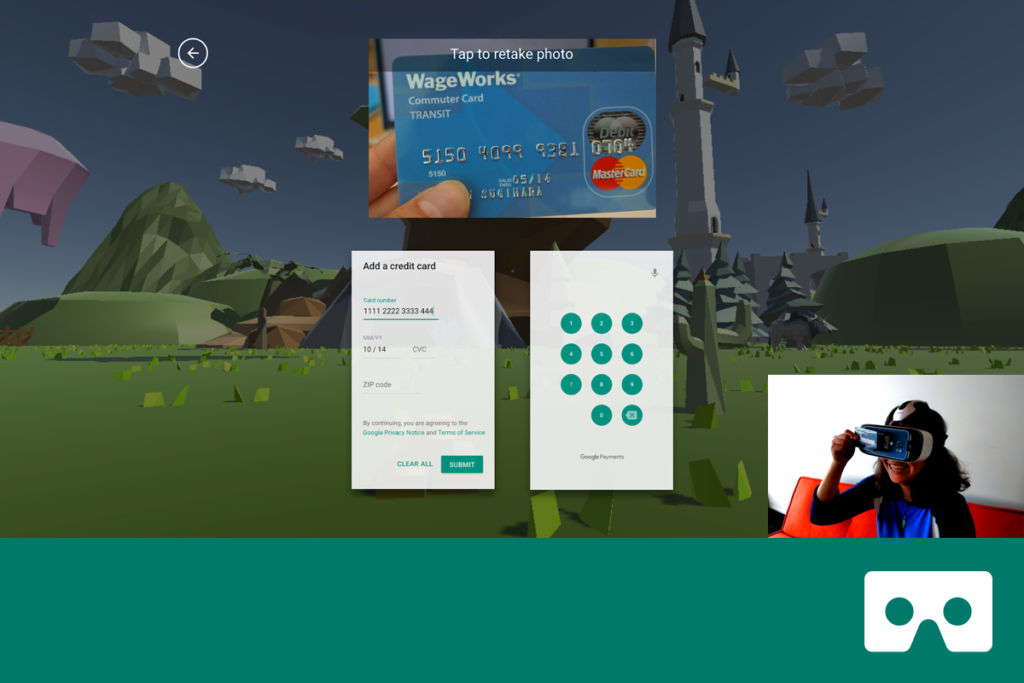

Payments VR

Payments VR was the 2-year vision of in-app purchases in virtual reality. I conducted user studies to test our VR prototype and verify design direction. Designed UIs for the prototype. Our team won the 2016 ACUX Sprint Week Innovation Award.

Z-bank

Z-bank is a project during 2016 Pulp Fiction Gaming Hackathon. The goal is to leverage the Zee interactive prototype and develop a fun way of teaching kids personal financial responsibilities.

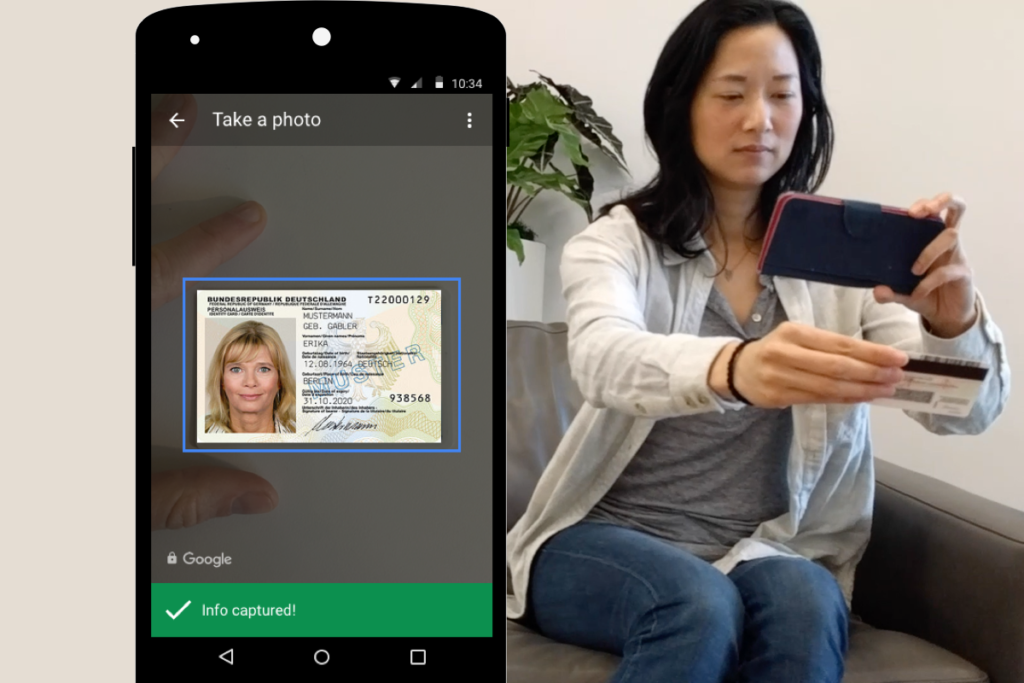

Global Buyer Identity Verification

This project was to redesign the Global Buyer Identity Verification (GBIV) experience, making it easier and more secure for European Google Payments buyers. We launched it in Q4 2017.

OTHER WORKS

© Hannah Chen 2019. All rights reserved.